- In 2022, credit spreads were positively correlated with rising government bond yields—resulting in heavy losses for credit investors. This year, the relationship has shifted; as government bond yields have risen, credit spreads have tightened.

- Bond yields are at much higher levels than two years ago, providing sufficient income to help cushion investors against any near-term volatility.

- Assuming economic conditions remain stable, we expect credit spreads to move within a narrower range than in recent years - which should allow corporate bonds to continue to perform well.

When inflationary fears caused central banks to hike interest rates in 2022, corporate bond investors faced a double whammy of rising government bond yields and widening credit spreads.

With government bond yields on the rise this year, it’s raised concerns that we could see a repeat of 2022 - when double-digit declines in credit markets took many investors by surprise. Yet the situation today is quite different from two years ago, and the shift in market dynamics could provide an ideal environment for active credit outperformance.

Decomposing the drivers of credit returns

To understand how things have changed in credit markets, it’s important to understand the drivers of corporate bond returns. The yield on a typical investment-grade corporate bond has two components: the portion relating to the yield on a comparable government bond, and the credit spread. The credit spread represents the risk premium an investor receives for the credit risk portion of a corporate bond.

When high inflation led central banks to hike interest rates in 2022, government bond yields started rising steadily. At the same time, credit spreads widened, amid fears that rising rates would cause a spike in defaults and delinquencies among corporate bond issuers due to higher financing costs.

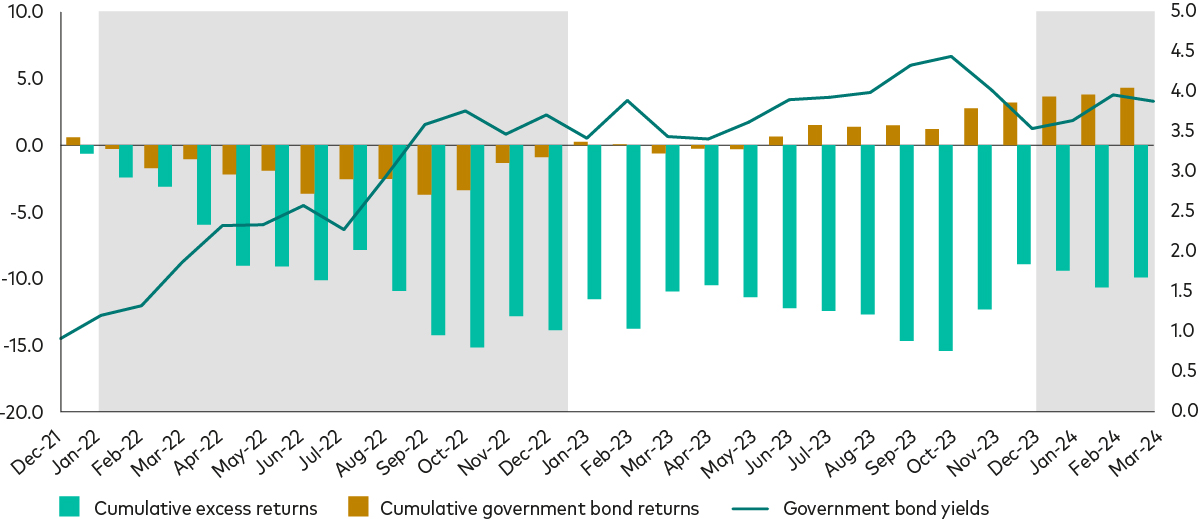

The anticipation of further rate hikes drove government bond yields higher and pushed credit spreads wider—resulting in heavy losses for government bond and credit investors in 2022, as illustrated in the chart below.

The relationship between credit spreads and government bond yields has shifted

Monthly cumulative returns for government bonds and monthly cumulative excess returns for credit, 2022-present

Notes: Cumulative excess return represents the credit-spread-related portion of the total return of the Bloomberg Global Aggregate Corporate Index. The cumulative government bond return represents the total return less the excess return of the Index. The government bond yield is the yield of the Index less the Index’s option-adjusted spread (OAS). Returns are cumulative and include reinvestment of all income, net of fees, for the period 31 December 2021 to 31 March 2024. Returns are hedged to USD. Source: Bloomberg, using Vanguard calculations.

A shift in the yield-spread correlation

Fast forward to 2024, and government bond yields, which had been pricing in several rate cuts this year, have been steadily rising once more—fuelled (again) by higher-than-expected inflation that riled markets to pare back their rate-cutting expectations for the year.

Yet the strong positive correlation between government bond yields and credit spreads that drove down credit returns in 2022 is missing in today’s market; instead, credit spreads, which were already tight coming into 2024, have tightened further while government bond yields have climbed higher (see the chart above). The shift is broadly due to a more supportive and stable economic backdrop compared with two years ago.

That’s good news for credit investors, in our view. Assuming economic conditions remain stable, we expect credit spreads to move within a narrower range than in recent years - which should allow corporate bonds to continue performing well, in total return terms, in spite of recent market turbulence.

There are a number of reasons why we think credit will continue to perform in the current market environment:

The economy is far more resilient than we thought

Despite the rapid rise in rates, the global economy has fared much better than many expected. Economic growth, especially in the US, has remained healthy, and despite a short period of weakness in Europe and the UK towards the end of 2023, the outlook for 2024 is constructive. This economic resilience suggests that the steep rate rises may not have been as restrictive as many initially feared and, at current levels, may be just right for helping bring down inflation while allowing the economy to grow at the same time.

Similarly, today’s higher rates haven’t had the adverse impact on corporate profitability or household finances that many expected back in 2022. This was largely due to firms refinancing their debt when rates were much lower, and locking in low-cost, long-term funding that has helped them absorb the subsequent rate increases with little impact on their creditworthiness. Excess savings and a robust labour market has kept the consumer strong as well.

Bond yields are much higher than in 2022

2022’s double-digit negative returns were largely driven by steep rises in government bond yields, which started the year at levels far below where they are now. Back then, yields on 10-year US Treasuries were around 1.5% and yields on 10-year Bunds were around -0.2%1. At such low yields, the income generated wasn’t enough to compensate investors for the subsequent sharp rate increases. Today, the yield on 10-year Treasuries is around 4.3% and the yield on 10-year Bunds is around 2.3%2 - sufficiently high to accommodate an additional one to two rate hikes. We do not anticipate a scenario where central banks will restart hiking rates - but if they do, today’s starting yields provide a better cushion for credit investors.

A stable economy can accommodate tighter spreads for longer

When the economy is stable, tight spreads don’t need to carry on tightening to still deliver positive excess returns for credit investors. A healthy economy can help reduce risk premia and keep credit spreads trading in a narrow range. If we consider the period from 2004 to 2007, which was relatively stable in terms of growth, inflation and interest rates, credit spreads were trading at even tighter levels than today (investment-grade credit spreads averaged around 0.7%; versus 0.9%-1.0% in the current market), delivering positive excess returns for credit investors over the three-year timeframe3.

Sector disparities offer active credit opportunities

Two years ago, fears about recession, fuelled by rising rates, took a toll on credit markets. That’s no longer the case. We believe the current uneven market environment and stable economic outlook are creating attractive opportunities for active credit selection. Since the pandemic, certain sectors of the economy have lagged in their recovery, providing potential pockets of value. For example, many hotels and airline companies are yet to fully rebound from their pandemic lows and are likely to offer further growth. Other sectors, such as real estate, were hit hard by the rate-hiking cycle and could offer attractive valuation opportunities.

Given this backdrop, active credit funds that focus on bottom-up security selection and have the credit research capabilities to identify undervalued and mispriced opportunities, have a distinct edge over those with a more top-down, directional approach. A selection-centric strategy can also help to preserve the risk-dampening qualities of bonds—giving investors what they expect from the fixed income asset class—high-quality, investment-grade holdings that should act as a diversifier relative to equities through varying market conditions.

1 Source: Bloomberg, as at 29 December 2021.

2 Source: Bloomberg, as at 24 April 2024.

3 Source: Bloomberg and Vanguard. Average investment-grade credit spreads are based on the option-adjusted spread of the Bloomberg Global Aggregate Corporate Index, for the periods 1 January 2004 to 1 January 2007 and 1 January 2024 to 31 March 2024. Excess returns are based on the period 1 January 2004 to 1 January 2007.

Our active bond funds managed in-house

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities, but is included for the purposes of illustration only.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved