One of the choices facing investors who are considering investing in ETFs is between funds that use physical replication and those that use synthetic replication1 . This article gives an overview of the two structures and aims to equip advisers with the information they need to make the most informed ETF selection decisions for their clients.

Physical ETFs

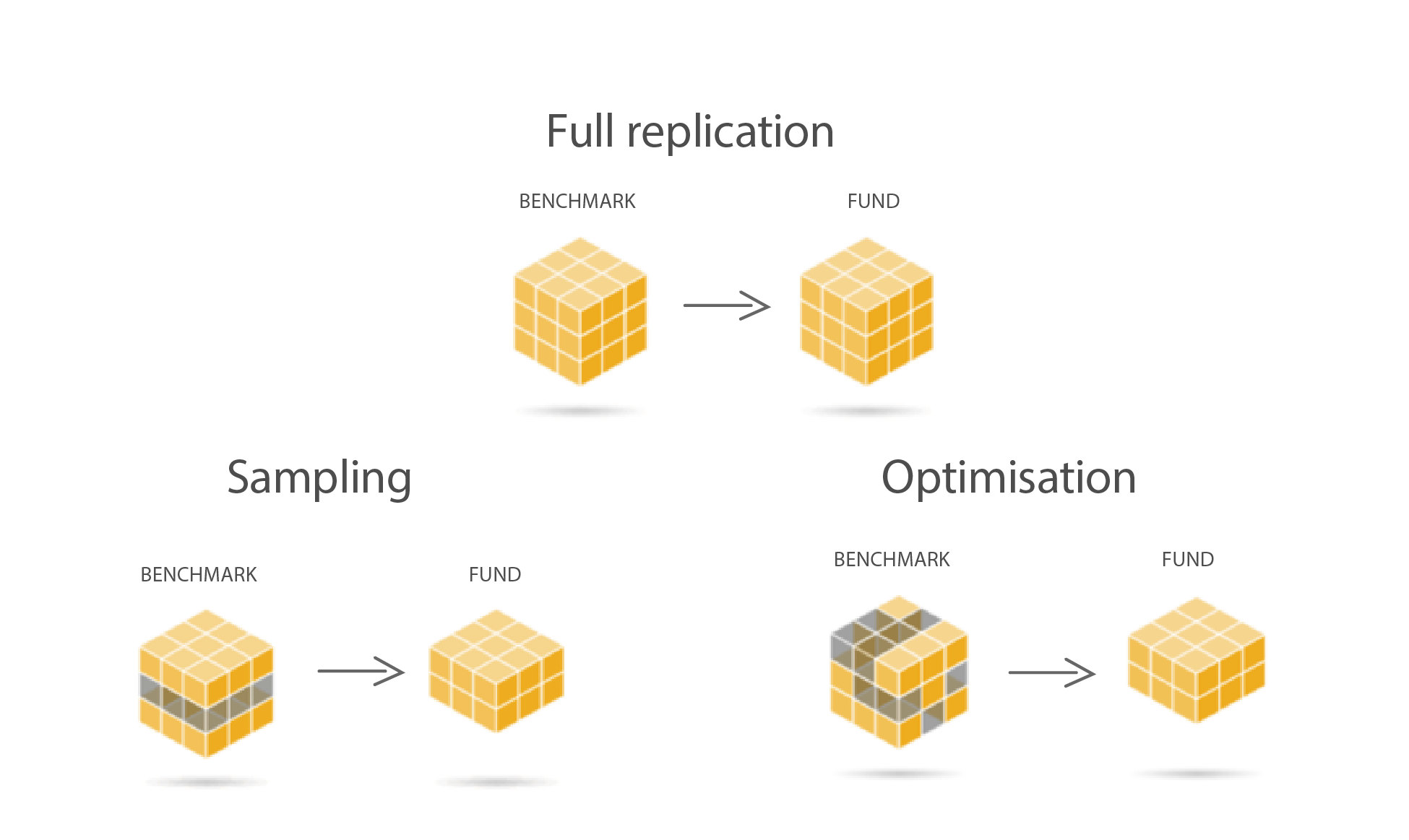

Physical ETFs hold the underlying constituents of an index. These ETFs tend to be more transparent and straightforward than alternative structures, and carry no or limited counterparty risk. They offer exposure to the performance of an index through three common approaches: full replication, stratified sampling and optimisation, as is illustrated below.

Physical replication approaches

Full replication

At Vanguard, our preference is to fully replicate the indices we track wherever possible. Full replication ETFs attempt to track the performance of the target index by investing in all, or most of, their assets in the stocks that make up the index, holding each stock or bond in approximately the same proportion as its weighting in the index.

This method is often used for ETFs that offer exposure to “plain-vanilla”, market cap-weighted benchmarks that track widely accessible developed-market equities, such as the S&P 500.

Sampling and optimisation

In certain circumstances, full replication may not be practical or cost effective. ETFs that adopt a sampling or optimisation approach hold only a subset of the parent index’s securities.

Sampling aims to match the risk and return profile of the index that the fund seeks to track and is typically used for ETFs that offer exposure to broad fixed income indices. Optimised funds are designed to minimise tracking error (the annualised standard deviation of excess returns versus the benchmark index) and this method is typically used for ETFs that track large, global equity benchmarks.

What both approaches have in common is that they are commonly used by ETFs that track indices with many holdings or less-liquid securities. For example, fixed income benchmarks typically contain a broader basket of securities than equity indices. In addition, many of the bonds in fixed income indices may be illiquid or difficult to access because many investors tend to hold bonds until maturity. For these reasons, ETF providers use sampling and optimisation to match the underlying indices’ characteristics, such as issuer, yield and term.

Unsurprisingly, ETFs that use sampling and optimisation techniques may suffer from higher tracking error than their full-replication counterparts. Skilled portfolio managers can minimise tracking error while reducing transaction costs, lowering turnover and maintaining liquidity.

It is important to note that while a fund’s prospectus may state that it uses optimisation or sampling techniques, a manager may fully replicate the strategy. The reverse is not permitted, however.

Key questions for physical replication

How broad is the desired exposure?

Are there difficult-to-access securities, markets (such as emerging or frontier) or assets (for example, commodities)?

Are there regulatory or legal restrictions which may make physical holdings less attractive (capital controls, repatriation restrictions)?

Which physical replication technique does the ETF use?

Does the issuer have the capabilities to effectively replicate the exposure physically (such as a sophisticated or global trading capability, a track record of offering index products and sufficient broker relationships)?

Does the issuer understand the local market trading and regulatory practices?

Does the ETF participate in securities lending?

Securities lending

Securities lending refers to the temporary transfer (‘lending’) of a security by one party to another in exchange for collateral, including cash, shares and bonds, for a fee. While swap ETFs can also lend securities, it is uncommon in practice because the securities in the reference basket do not usually generate high fees. ETFs that engage in securities lending carry an element of counterparty risk, which is the risk that the borrower will fail to return the securities, and includes the risk of the borrower’s insolvency. To mitigate the risk of default, borrowers also post collateral of equal or greater market value than the loaned security. Borrowers and lenders are often connected via agents, such as banks, which collect a portion of the lending proceeds. Securities lending revenue can offset a fraction of the ETF’s ongoing charge, which can reduce the total cost of ownership and improve the fund’s tracking performance. Unlike most lenders, Vanguard does not take a percentage of lending revenue. Instead, all securities lending revenue, net of programme costs, is credited to Vanguard funds.

Key questions for securities lending

How much of the gross revenues from securities lending are allocated to the ETF and how much is passed onto the fund’s manager?

What is the ETF provider’s approach to securities lending?

What is the provider’s approach to borrower selection?

Does the provider offer a form of borrower default indemnification?

Is there a maximum percentage on loan?

What type of collateral is accepted?Is there a maximum percentage on loan?

What type of collateral is accepted?

Synthetic ETFs

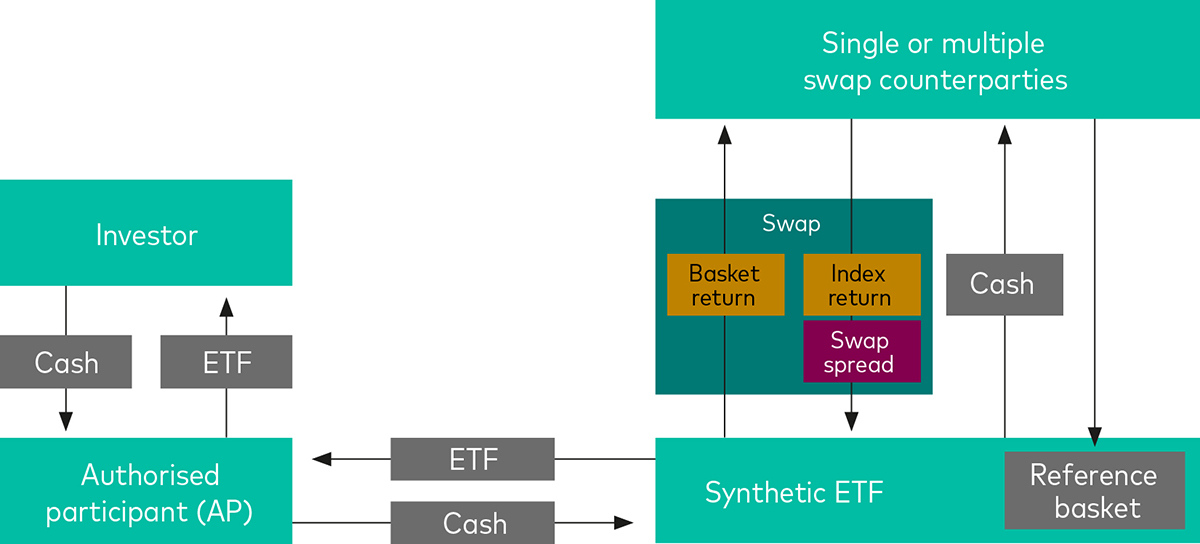

Synthetic ETFs capture the return of an index using swaps. A swap counterparty pledges to deliver the performance of an index for a variable spread, which is paid by the ETF.

Synthetic replication is commonly used in the emerging markets equity space. This is because emerging market stocks tend to be less liquid and harder to access than their developed market peers. It is also widely used for UCITS ETFs tracking the S&P 500 Index. This is because in the US, synthetic ETFs offer a tax advantage over their physical peers. Certain equity-linked instruments, including synthetic S&P 500 ETFs, are exempt from withholding taxes, and therefore receive 100% of the dividends paid by stocks in the S&P 500.

While single-commodity ETFs are typically physically replicated, offering direct exposure to precious metals stored in high-security vaults in Switzerland, UCITS ETFs that track a broad basket of commodities tend to use synthetic replication. These indices are based on rolling futures contracts rather than physical assets, which are more impractical to trade owing to storage and insurance costs.

Synthetic ETFs adopt two main approaches: the unfunded model and the fully funded model.

Unfunded model

Under the unfunded model, the ETF enters into a total return swap agreement with a single counterparty or multiple counterparties (thereby mitigating counterparty risk). Under this arrangement, the ETF uses investors’ cash to buy a reference basket, also known as a substitute basket.

This basket is often purchased from the swap counterparty and is typically ring-fenced as part of a tri-party or in some cases quad-party agreement whereby the assets are held separately from those of the asset manager or swap counterparty for the purposes of risk control and asset segregation.

In return, the swap provider pledges to provide the performance of the chosen index to the ETF. Meanwhile, the ETF provides the return of the reference basket to the swap provider, as seen in the figure below.

In the unfunded structure, the reference basket may contain securities that are not associated with the underlying index. As such, if the counterparty defaults, the investor will no longer maintain exposure to the desired index.

Compared with physical funds, synthetic ETFs that follow the unfunded model are exposed to a higher level of counterparty risk. This risk can be measured as the difference between the ETF’s net asset value (NAV) and the reference basket’s value. According to the UCITS directive, this difference, (often called the valuation gap) cannot be greater than 10% of the ETF’s NAV2.

Swaps are marked-to-market on a daily basis. If exposure to the swap counterparty exceeds 10% of the fund’s NAV, the swap is ‘reset’. In this instance, the counterparty transfers additional securities to the reference basket. Swap reset mechanisms vary from product to product and are usually triggered at a predetermined level as part of the counterparty swap agreement. The contract details are not always made publicly available.

The unfunded swap model

Due diligence

Using synthetic ETFs that follow the unfunded model requires additional due diligence for several reasons. Firstly, the securities in the reference basket, which are often chosen and purchased by the swap counterparty, may not be as liquid as the underlying index. With that in mind, advisers holding synthetic ETFs for their clients should check the securities in the reference basket on ETF providers’ websites.

Secondly, the reference basket often exhibits a different risk and return profile to the underlying index that the synthetic ETF is seeking to track. Advisers are encouraged not only to assess the quality of the basket but also ensure that its asset allocation is in line with the client’s risk and return profile. This can be challenging. While most synthetic ETF providers publish constituent data for the reference basket on a daily basis on their websites, historical holding data is not as easily accessible. This makes it difficult to analyse how the composition of the basket varies over time compared with the underlying index.

Fully funded model

Under the fully funded model, the ETF transfers investors’ cash to the counterparty, which in return provides the performance of the underlying index. To mitigate risk, the counterparty posts collateral with an independent third party, such as a custodian.

The collateral can either be held in the ETF’s name (transfer of title) or in the name of the counterparty but pledged in favour of the ETF (pledge agreement). If the counterparty defaults, the custodian transfers assets from the segregated account to the ETF’s custody account under the transfer of title arrangement. Meanwhile, under the pledge agreement, collateral is posted to a pledged account in the name of the counterparty. As such, the ETF doesn’t have direct access to the assets.

Advisers holding synthetic ETF for their clients should always check the composition of the collateral baskets.

This information may or may not be shared on ETF providers’ websites. According to UCITS rules, the collateral basket must comply with liquidity and diversification requirements. Additionally, synthetic ETF providers often mitigate counterparty risk exposure via full or over collateralisation.

As in the case of the reference basket, the composition of the collateral pool differs from that of the underlying index. During periods of increased market distress, trading securities in the collateral basket can also be challenging, especially if the underlying market is closed.

Trade-off between tracking error and transparency

Generally, synthetic ETFs tend to experience lower tracking error than their physical peers. This outperformance can typically be seen in less-liquid sleeves of the market, such as emerging market equities, where physically replicated ETFs are more likely to use sampling or optimisation techniques.

While synthetic ETFs tend to offer lower tracking error compared with their physical counterparts, they are also less transparent when it comes to tracking difference (fund return less index return)3. For synthetic ETFs, the main sources of tracking difference are ongoing charges and swap spreads. The ongoing charge has a negative impact on an ETF’s tracking difference, while the swap spread may contribute positively or negatively.

Overall, it is difficult to conduct accurate tracking difference attribution on synthetic ETFs. While ongoing charge data is publicly available, swap spread details are less widely shared. To increase synthetic ETF transparency, swap providers could become more forthcoming with information on swap costs and resets.

Key questions for synthetic replication

Is the swap exposure to a single counterparty or is it diversified across several counterparties?

Is the value chain – namely fund promoter, market maker, swap counterparty and custodian – transparent? Are there any potential conflicts of interest?

What is the current and historic swap spread? How often do swap spreads change and how are changes communicated to investors?

What are the rules that determine the quality and liquidity of the reference basket?

If the swap counterparty defaults, what is the process and expected time frame to appoint a new counterparty?

What is the quality of the collateral basket and is the asset allocation in line with the investor’s risk profile?

For fully funded swap structures, how easy is it to gain access to the collateral in case of counterparty default?

How often is the swap reset and what is the target level for the collateral or reference basket?

Are the constituents of the reference basket or collateral holdings publicly available?

Is the level of counterparty risk published on the provider's website?

Key takeaways

When considering which ETF structure is best for your client, consider ownership rights, tracking expectations, asset class exposure and product complexity.

Physical ETFs are generally more transparent, straightforward and easy to understand.

Synthetic ETFs can offer efficient access to less liquid and more niche areas of markets.

Synthetic ETFs generally have lower tracking error than their physical counterparts but a lack of transparency over swap costs makes it difficult to assess tracking difference.

1 Synthetic replication may also be called derivative replication.

2 Synthetic ETF providers may apply more stringent criteria than what is required under the UCITS directive.

3 Synthetic ETFs under the Microscope: A Global Study, Morningstar ETF Research, May 2012.

This is a summary of An Overview of Physical and Synthetic ETF Structures by Marco Corsi, PhD, Nusrath Hussain and David Hsu, published in December 2020.

If you have completed all content in the module, you are ready to take the quiz and collect your CPD

Ready to test your knowledge?

Take the quizMore from Vanguard 365

Client relationships

CPD content crafted to empower you to service your client’s needs effectively, build relationships, create loyalty and achieve new business growth.

Practice management

CPD content designed to help you build your practice, market your services effectively and cultivate a thriving professional network.

Financial planning

CPD content structured to give you access to useful tools, guides and multimedia resources covering diverse topics from risk profiling to retirement planning.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

This article is directed at professional investors and should not be distributed to, or relied upon by retail investors.

This article is designed for use by, and is directed only at persons resident in the UK.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this article does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

The information contained in this article is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Asset Management, Limited. All rights reserved.